Stakeholder Workshop

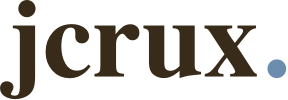

A series of cross-functional workshops were set up to focus on the customer experience and how the customer’s journey will intersect with key business technologies and infrastructure to unify priorities and approaches across teams and channels for cross-sell, upsell, and multi-product initiatives.

Workshop goals

The output from these workshops will be a refined set of opportunities—presented in the form of customer-centric stories—which will be used to prioritize experiments, research, and feature work post-MVP Next Best Action initiatives.

Outcomes

Kick-off included an initial subject matter expert presentation to a large group of executives and domain leaders to ensure a complete end-to-end grasp of the full scope of domains covered in this initiative. Each SME will be presented with key aspects of how their domain operates today, including target customer profiles, key business goals, initiatives in flight, and operational processes.

In the following days 20 domain leaders across, Product, Technology, Sales, and Marketing participated in two workshop sessions and provided the following outcomes:

Initial How Might We statements

HMW include our HR & Finance partners in these sessions?

HMW bring our VoC team and activate them as a channel

HMW we include the credit and underwriting team to provide industry insights that can enhance targeting

How might ESRM be able to utilize eNBA?

HMW use call disposition data for future targeting.

HMW tie the high-fidelity signals within our targeting models to the specific marketing messages we test.

HMW use supplier NPS responses to inform targeting?.

HMW incorporates data on % of rev flowing through C2FO for an individual company? Low % of rev, bad target for EP, and may need Capfin to entice a solution. High % of rev, good for EP conversation

HMW make the supplier app more engaging, so suppliers can give us more information about their own cash needs, and who their out-of-network customers are

HMW keep the process for SRM simple but collects detailed feedback?

HMW use NBA to surface up more CapFin VIPs.

HMW target suppliers for CapFin that are outside of the C2FO Early Pay Network.

HMW we extrapolate learnings and the process for NBA onto the buyer side?

HMW create a lighter/self-service discovery pipeline survey with Suppliers?

HMW use the NBA to offer more self service opposed for Low spot suppliers with/ no SRM support?

HMW measure increases in efficiency/success post eNBA & SCV rollout to present back to SRM to build trust in the new processes?

HMW optimize the sales process based on measurable targets and the effectiveness of each flow.

HMW create a single back-end place that can be referenced for supplier contact and information across products (things like phone number, uploaded KYC/KYB docs, etc) so that each product doesn't have to ask?

HMW use the data we have to prequalify supplier accounts for a CapFin or Card product?

HMW learn from early pay objections to better promote other products?

HMW leverage a supplier giving access to a bank account or financial tool to learn more about their pre-qualification for a new product?

HMW target suppliers who haven't participated in DD yet for other products. Or should we always target DD first?

HMW ensure our products are promoted with one another vs. this is better than that

HMW create standard metrics to measure effectiveness across all marketing and SRM activity?

HMW measure and track the ROI of implementing NBA to in-app, marketing, and SRM channels?

HMW have a transparent roadmap/backlog to view all channels together? In-App, Email, and SRM

HMW incorporate experience platform customer journeys with marketing journeys to better understand the customer holistically?

HMW create a centralized marketing roadmap across products and channels so we have a full picture of all campaigns going out, when, and to which segment so adhoc

Workshop sessions

HMW identify and correctly engage with actions taken outside of NBA to inform how we can best service the customer. From a data standpoint, how does this all work together to inform a certain customer journey path?

HMW define and communicate product "qualification" to NBA

HMW correctly communicate NBA suggestions to SRMs to net the most effective communication? How might we increase trust within the NBA system or Identify whether NBA is meeting our expectations?

HMW scratch all the communications that we are sending to suppliers, take a hard look at how each campaign performed, learn from them and build a new strategy with clear goals. Start simple and then build on top of it.

HMW make NBA so smart that it also tells us what to show to the customer either in app or outside digitally , at what time and via what channel.

HMW align all our various data collection systems' capabilities seamlessly?

HMW ensure SRM are filling out the discovery questions/notes completely and accurately in SFDC? Bad data in is bad data out of eNBA

HMW learn from supplier's actions - if they do apply for card, have Capfin, and use early pay - how do we give them the best cross-product experience? (aka what if this works!?)

HMW better expose the needed information to our consuming applications to present product fits

HMW ensure we don't introduce friction and make interacting with any of our products overly complicated

HMW ensure our products are promoted with one another vs. this is better than that

HMW fallback to another product when what we "think" is the best product is declined by the user

HMW understand/ measure our most valuable customers based on being multi-product accounts?

HMW prompt SRM to sell the right product at the right time

HMW Surface relevant talking points to the SRM for the recommended product

HMW learn from early pay objections to better promote other products?

HMW create the feedback loop that allows NBA to improve over time

HMW have governance on the NBA solution so we can periodically test and validate the actions we are recommending are relevant and accurate.

HMW measure and track the ROI of implementing NBA to in-app, marketing, and SRM channels?

HMW increase transparency and provide easy to understand information on some of the more complex aspects of NBA? Example: targeting, qualification, etc.

HMW ensure we are investing in making our upstream data sources primarily our supplier data complete and accurate so we can make accurate recommendations in NBA

HMW create a single back-end place which can be referenced for supplier contact and information across products (things like phone number, uploaded KYC/KYB docs, etc) so that each product doesn't have to ask?

HMW use the data we have to prequalify supplier accounts for a CapFin or Card product?

How might we break down, measure, and analyze the "top of the funnel" (lead/prospects) insights to provide next best actions that can be viewed by teams across the org

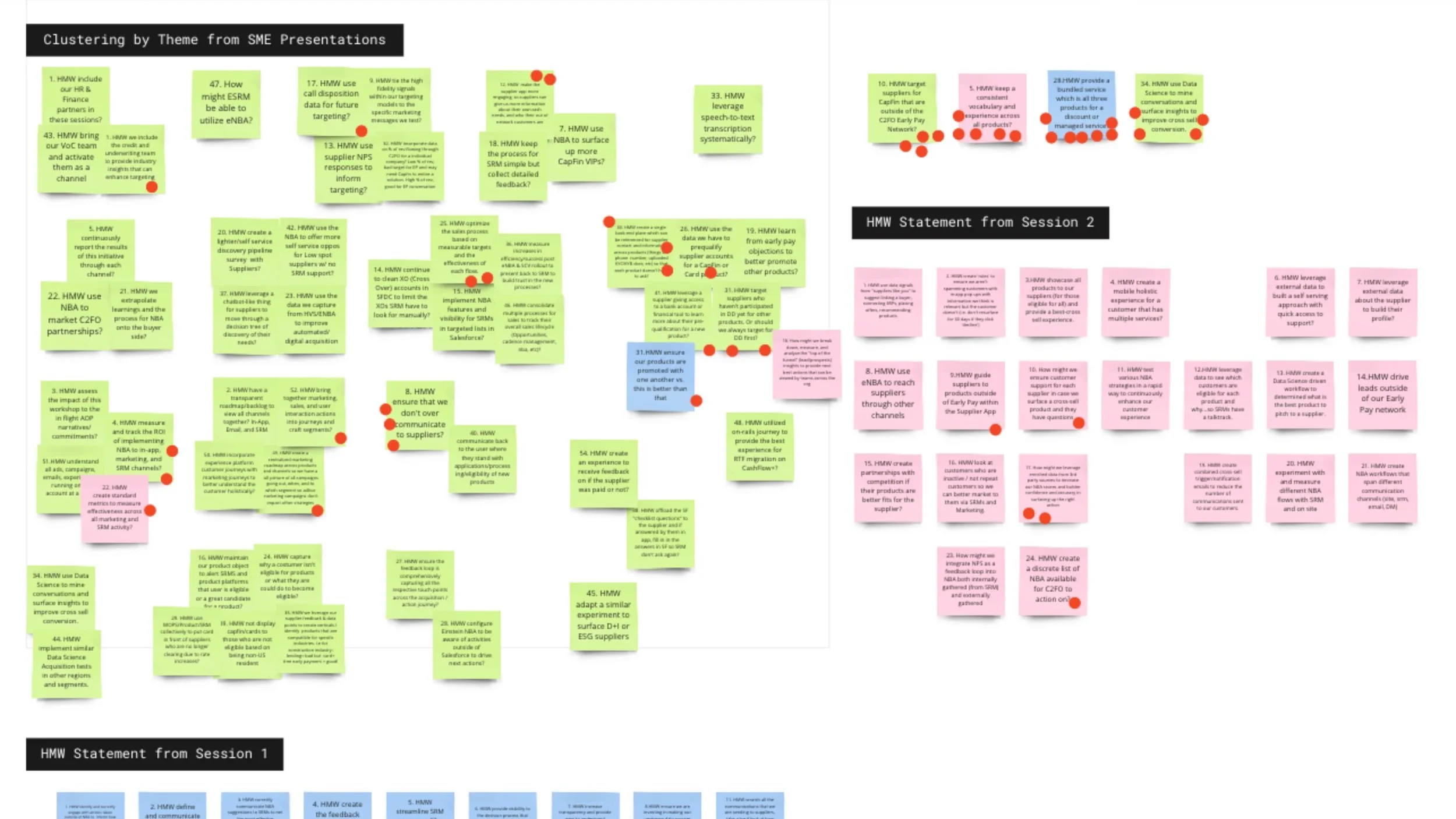

Storyboarding

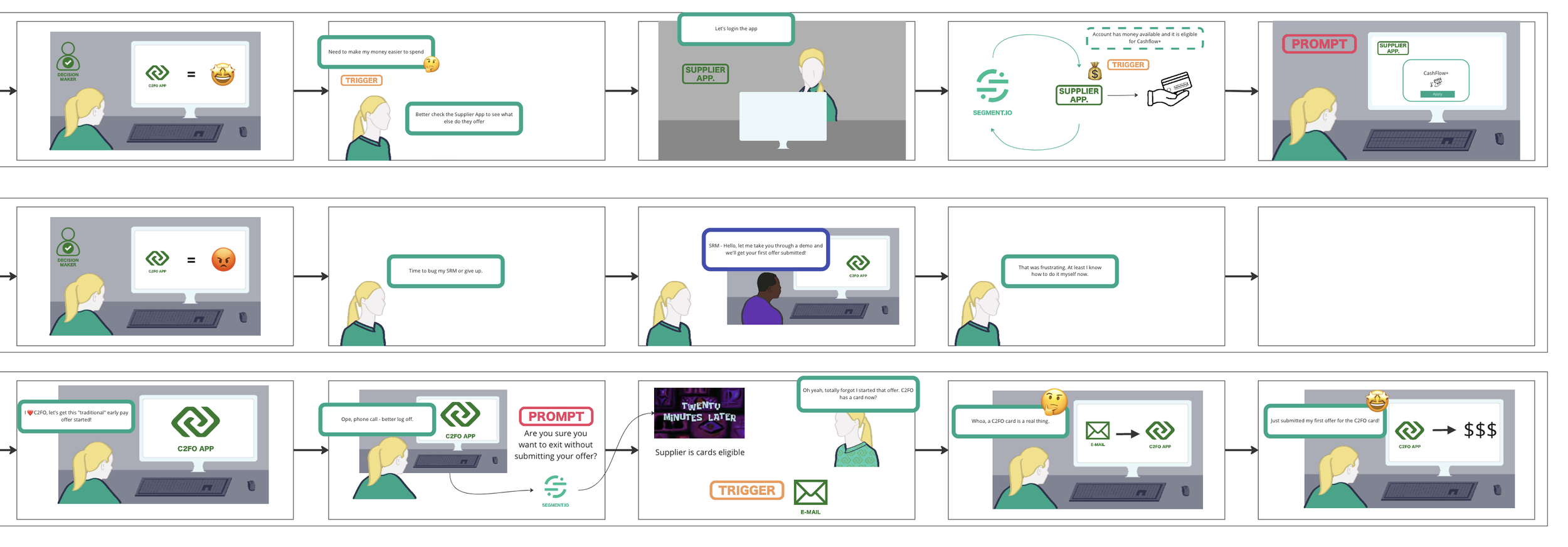

Happy Path NBA recognizes something in the data, sends an action to the salesperson, the salesperson acts on it, needs are met or not met, and NBA learns from it.

Cross-Channel Path Supplier gets denied by CapFin underwriting. Supplier doesn't want to pay discount in EP app. SRM logs this data. NBA recognizes through data provided during the underwriting process and pre-approves them for Card. They are recommended cards and they use them.

Unhappy Path We try to go in too many directions at once. We don't have a targeted approach and we don't get the feedback we need. We lose trust before we learn what we need to learn. Overcomplicating the process.

Short Timeline Path Get to the gatekeeper, don't let us through, have very little feedback. NBA uses data that it has learned and limited data on this supplier to recommend an action either to SRMs or Marketing to get the right contact / get them to use our products.

HMW create the feedback loop that allows NBA to improve over time

HMW learn from EP to better promote, track and increase the ROI of implementing NBA to in-App, marketing, and SRM Channels?

Happy Path srm feels confident in the benefits of all C2FO products and who to approach with what product when the supplier opens an email and registers/logs in self-investigates product offerings srm calls them at the perfect moment and does a thorough and everything works. They sign up and learn about all product and starts participating. Their actions inform eNBA and it learns more about the supplier

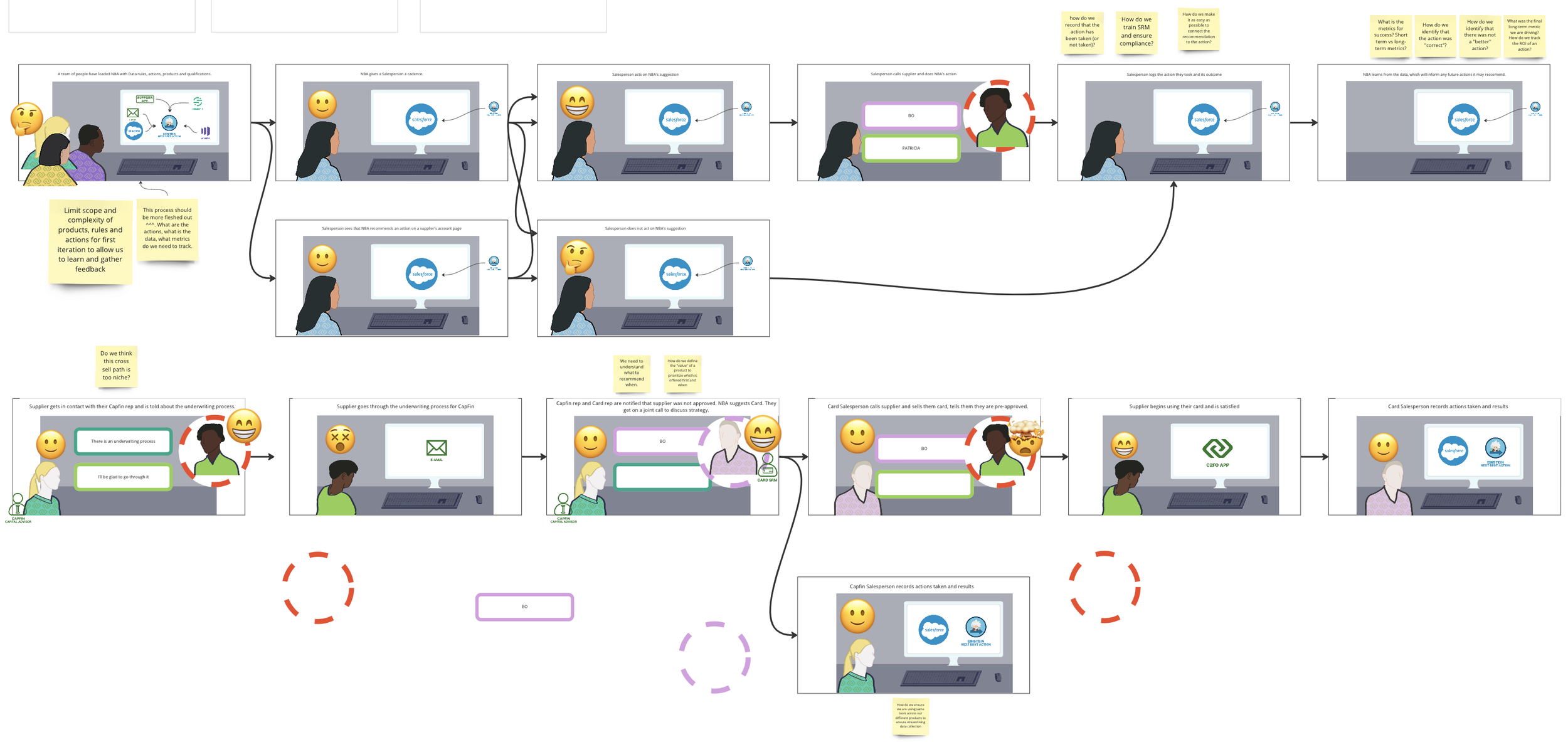

Cross-Channel Path NBA alerts that a supplier might be interested in a certain product and they are most likely to register. This supplier usually logs in via mobile They have PWA installed So in addition to Email/ show them a push notification on mobile.

Unhappy Path NBA alerts that a certain supplier should be reached out for Cards. It is an SRM-assisted account - so SRM reads the NBA signal and reaches out to the supplier. Supplier shows no interest in CARDS and politely declines. An email campaign is scheduled to send out triggered and Now the supplier is to get an email about the same. Growth Marketing has an automated process that shows an In-App message in case NBA shows Cards interest for a certain supplier. The In-App message is scheduled when the supplier logs in.

Short Timeline Path NBA alerts that a set of suppliers are most likely to participate in EP via an actionable offer if the offer is sent at a certain time on a certain day. NBA also pulls in region information and supplier historic activity records to recommend the channel of delivery.

Happy Path A lifelong traditional EP customer is now looking for a way to quickly pay business costs digitally.

Cross-Channel Path User receives email indicating invoices are available Logs into the app and receives notification of new invoices User begins to build an offer and multiple applicable products are recommended

Unhappy Path Supplier has a tough time understanding EP without some sort of upfront time investment. (SRM leading through first offer)

Short Timeline Path Abandoned Cart Offers User begins to build an offer, abandons, and we respond sometime after with an "enhanced" (similar) offer